As the 2018 year end countdown begins, now is a good time to judge my 2018 Wine Trends for BC Wine Enthusiasts predictions.

Here is how I would score the trends predicted for the BC Wine Market. If you disagree please leave a comment below.

Millennials Drive Wine Trends

Millennials care little about the origin or vintage of the wine they drink. They’re more interested in the experience of wine.

They take a huge interest in new wines and wines from unfamiliar regions. Millennials are more likely to be attracted to a blog, social media recommendations from friends or wine apps.

Score B

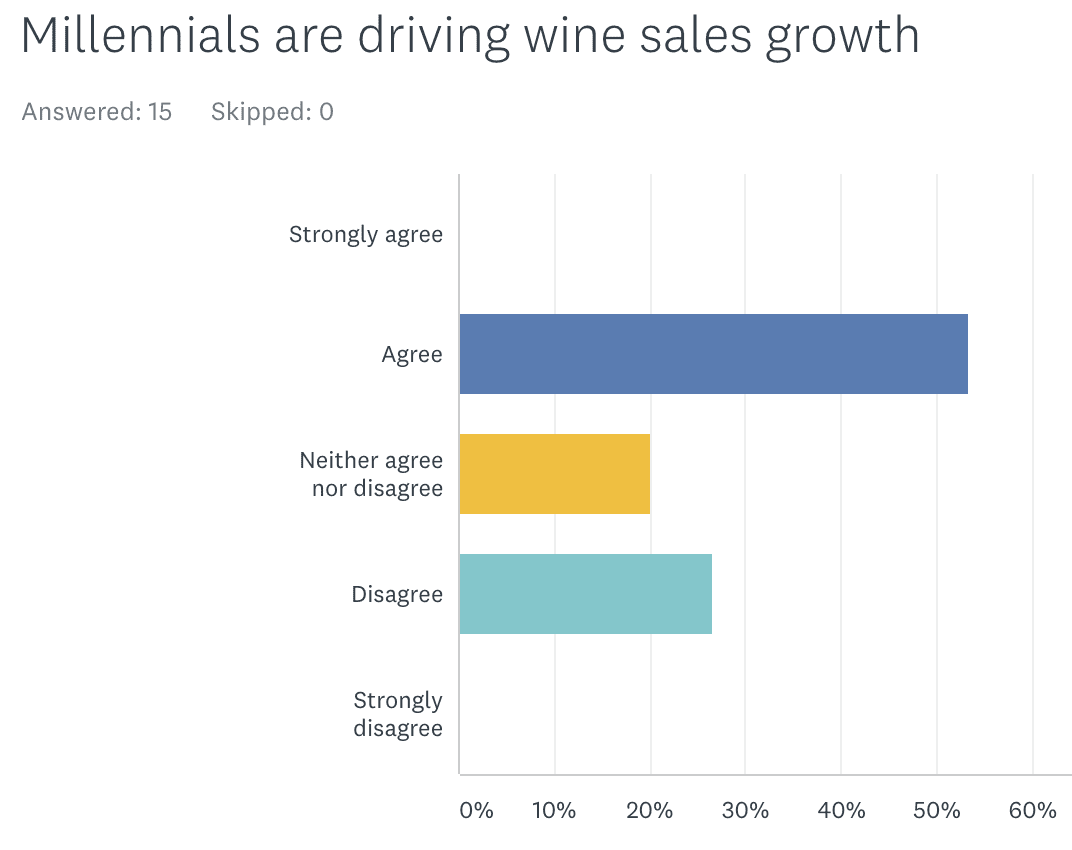

Winery owners agree that Millennials drive wine preferences and wine sales.

Below are the results from the recent BC Wine Industry Survey.

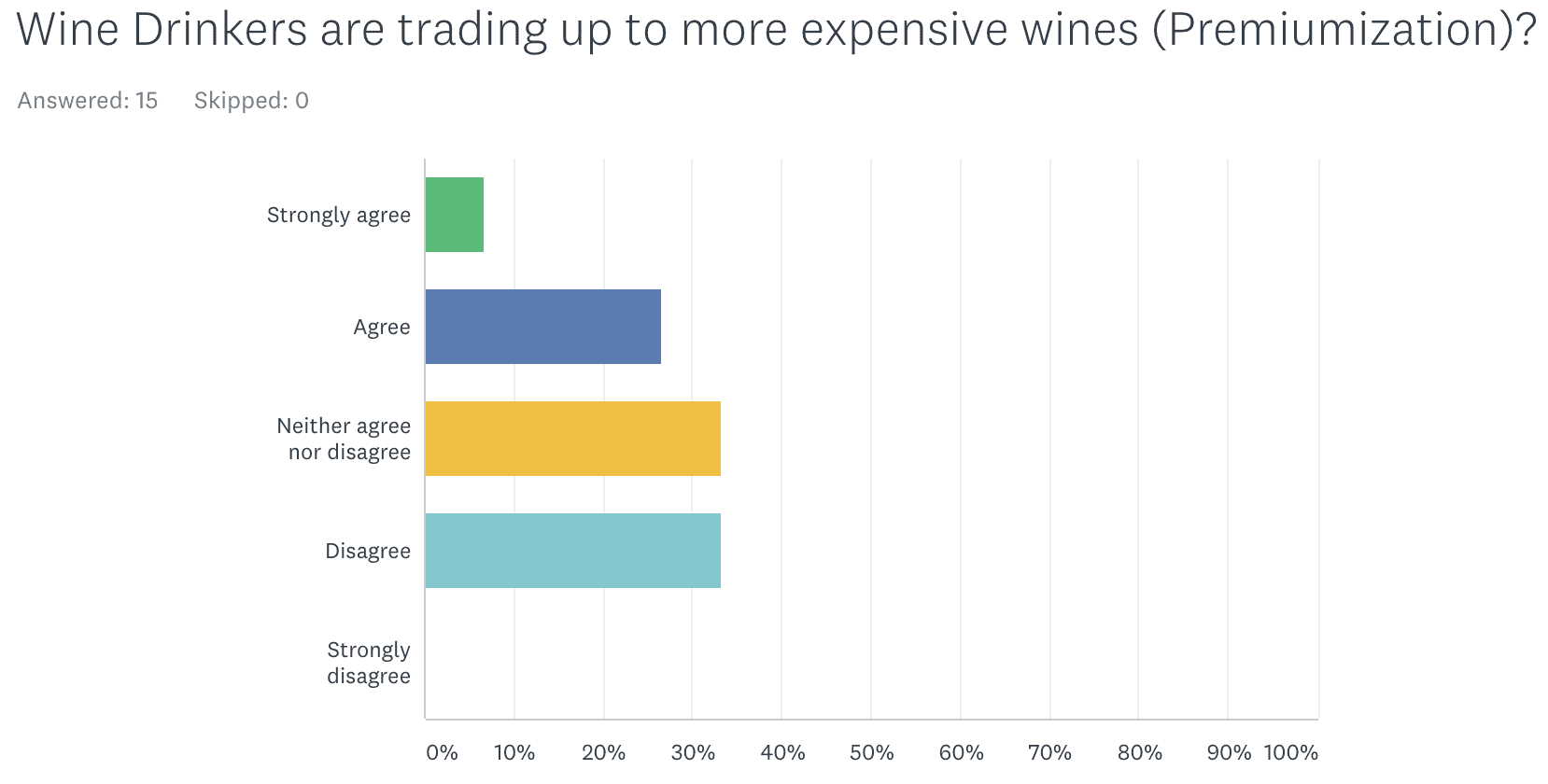

Premium Wine Growth

The desire to try a more premium product and pay more for it or “premiumization” is expected to continue in 2018 for wine and other alcoholic beverages. “Buying up” is often an easier sell at restaurants than wine sellers, where drinkers are looking more for an exciting and elevated experience than simply purchasing a bottle to unwind with after work. A higher consumer confidence rating in 2018 means consumers will continue to trade up to more expensive wines.

Premiumization is definitely happening in the rosé segment. The growth of rosé is beginning to wane in the US. Which isn’t a necessarily a surprise, given that the explosive rise of the pink stuff couldn’t be sustained forever.

In the US, rosé from the Provence region of France continues to grow. Provençal rosé is light and crisp, without the soft fruits found in many of its North American counterparts. I would expect many BC producers to concentrate more on Provence style rosés.

Score C

No significant general trend towards premiumization.

There were two parts to the premium wine trend. Rosé is broken out as a separate category.

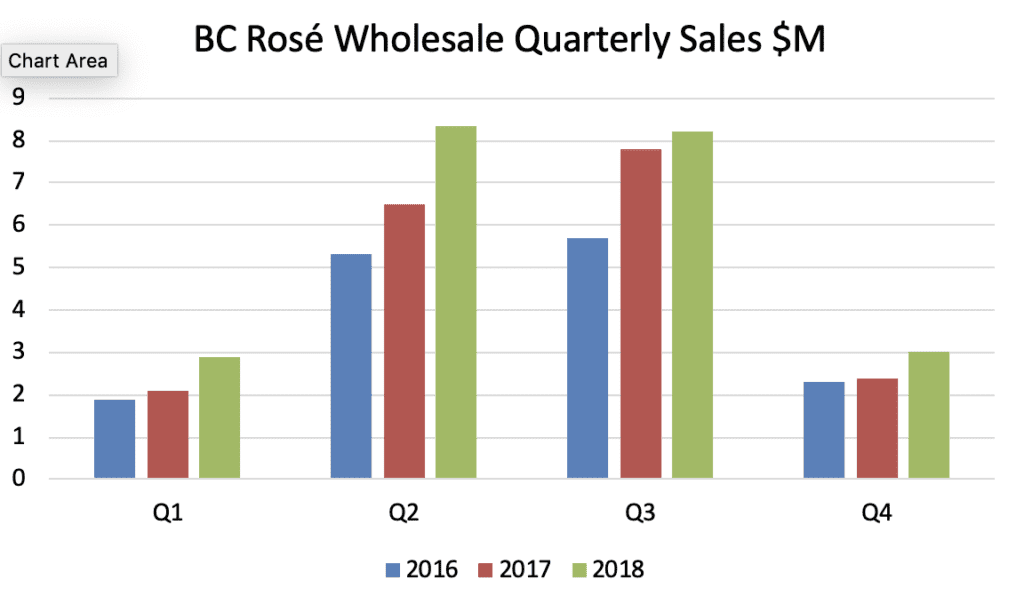

Rosé

BC Rosé sales saw 19% YoY growth in 2018.

Other Wine – Not Rosé

It is difficult to obtain BC Wine sales metrics by price category.

The average price for BC wine at the wholesale level shows a quarter over quarter price increase of only 2% through the 9 months of 2018.<2>. The data was extracted from the latest BCLDB liquor Market report.

| Year | Quarter | Q 0ver Q Price Increase |

| 2018 | Q3 | -0.54% |

| 2018 | Q2 | 4.68% |

| 2018 | Q1 | 3.14% |

| 2017 | Q4 | 2.53% |

| 2017 | Q3 | 3.30% |

Given that grape prices

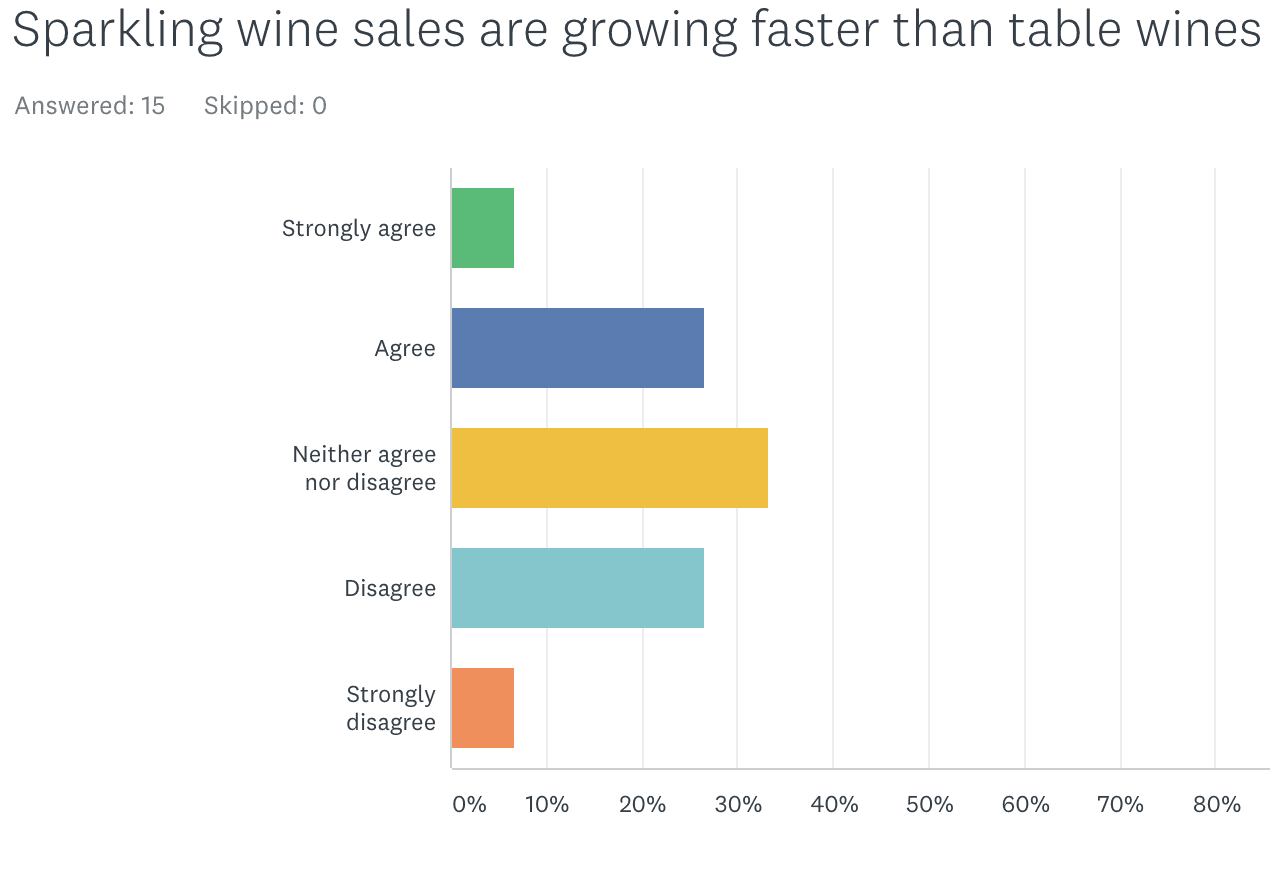

Sparkling Wine Growth

Prosecco sales have gone through the roof in the United States, and it’s millennials who seem to be behind Prosecco’s rise. This trend has spilt over to BC and with affordable Prosecco fueling growth in the whole sparkling wine segment.

Score B+

The chart below shows solid 10% YoY growth for 2018

Sparkling wine sales were flat sales in Q2 and Q3, but growth picked up again in the Holiday quarter.

The survey of BC Winemakers shows that some wineries are not seeing sparkling wine sales growth.

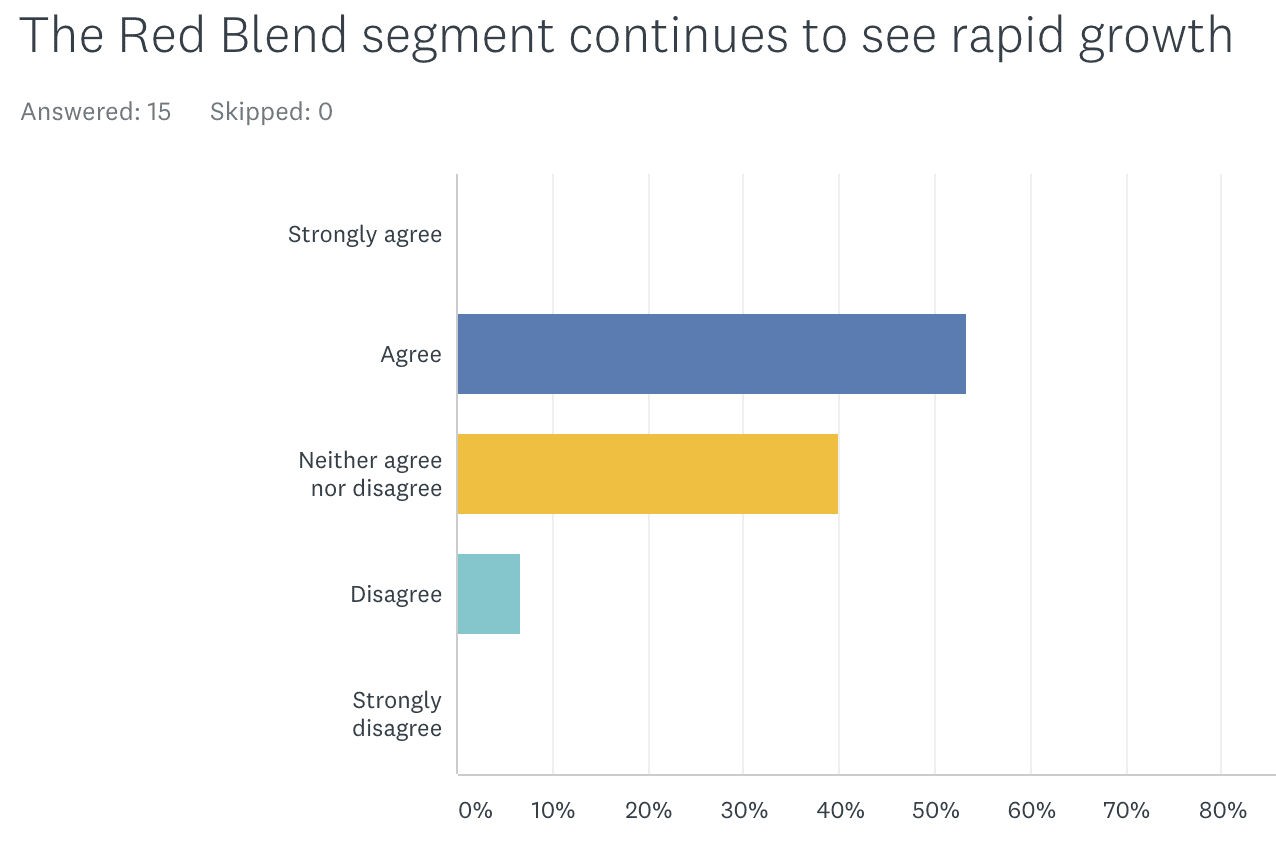

More Red Blends

One of the reasons this category is set up for continued growth is how open and freewheeling a category it is. Red blends offer a perfect palette for winemakers to mix grapes, blending, and mimic other styles.

Score – A

Red Blend as a growing wine segment is confirmed

Acquisitions will continue

Given the high cost of wine production in BC and the current investment climate, more consolidation in 2018 is expected.

Score – B

Acquisition continued but at a slower pace. Vineyard purchase by Estate Wineries is a strong trend.

After the blistering pace of winery acquisitions in 2017, it was to be expected that the pace would slow this year. In June, Diamond Estates acquired Backyard Vineyards of Langley for $3 million in stock <5>. In November, Von Mandl Family Estates, founded by Anthony von Mandl, announced it has acquired Road 13 Winery from the Luckhurst Family <9>.

We saw a strong trend for wineries to purchase vineyards in 2018. This was due in part to the shortage of BC wine grapes experienced in 2017.

Black Market Wine Co. purchased a vineyard in Kaleden this summer as their estate winery site.

Okanagan Crush Pad Winery acquired Secrest Mountain Vineyards Ltd in Oliver, BC. The 50-acre vineyard was planted in 2000 with Pinot Noir, Gamay Noir, Chardonnay, Pinot Gris, Pinot Blanc and Gewürztraminer. The property has been under lease to Okanagan Crush Pad since 2010 and is currently transitioning to organic certification <6>.

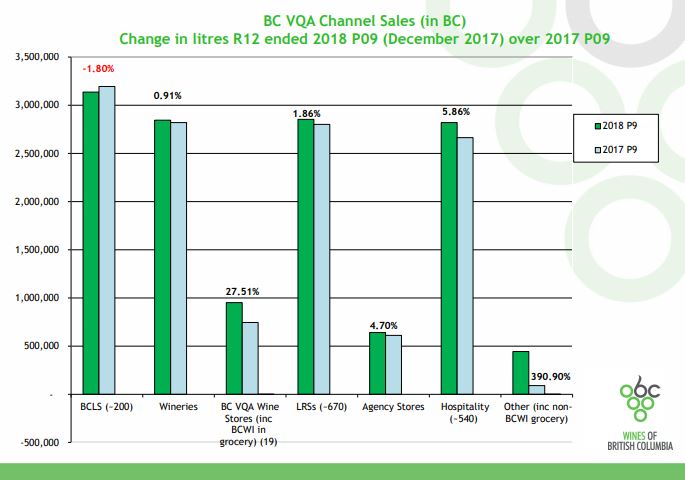

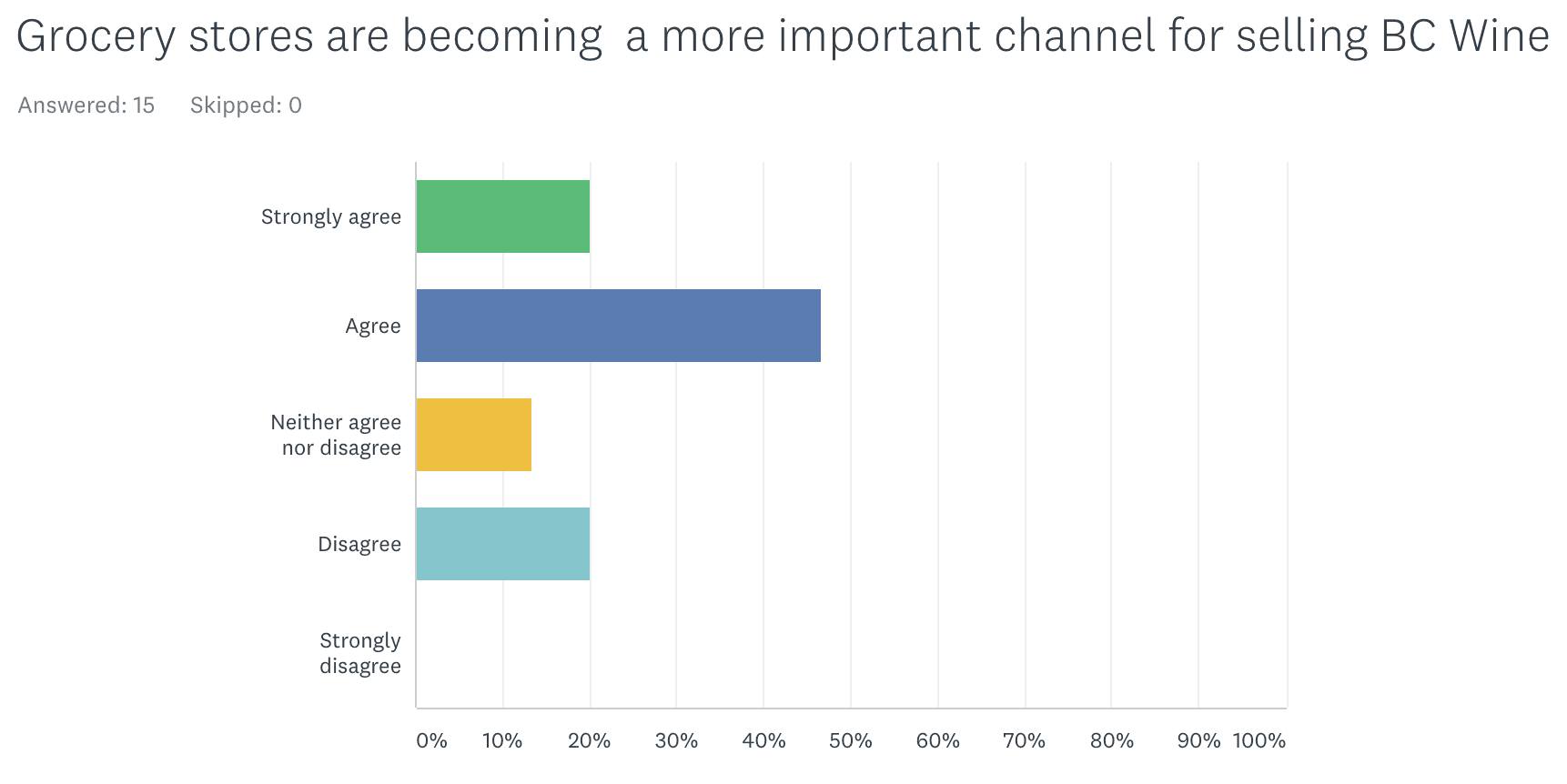

Grocery Store Channel Expands

BC Wines sales in grocery stores are becoming a more significant distribution channel. Vancouver remains the outlier for Grocery sales.

The current WTO dispute with the US and other trading partners over exclusive BC wine sales in grocery stores is a concern. Will this lead to an end of BC wines’ competitive advantage and cheap international wine also being sold in grocery stores?

Score – A

Grocery Stores become a more important channel for BC Wine Sales.

Grocery store sales of BC Wine did increase significantly. There was also some good news for Vancouver BC wine drinkers – Finally, Good News for Vancouver BC Wine Enthusiasts

Unfortunately the other prediction that BC would also have to allow the sale of imported wines in grocery stores also came true – BC Wines to lose Grocery Store exclusivity as part of the new USMCA agreement

Marijuana – The Wild Card

Score – Jury is still out

Cannabis was legalised in Canada in October so it is too early to tell if Marijuana sales will cannibalize the low end of the BC wine market.

However, I will predict this as a strong trend for 2019. It is interesting that Constellation is betting on Cannabis rather than medium priced wine in the US market <7>.

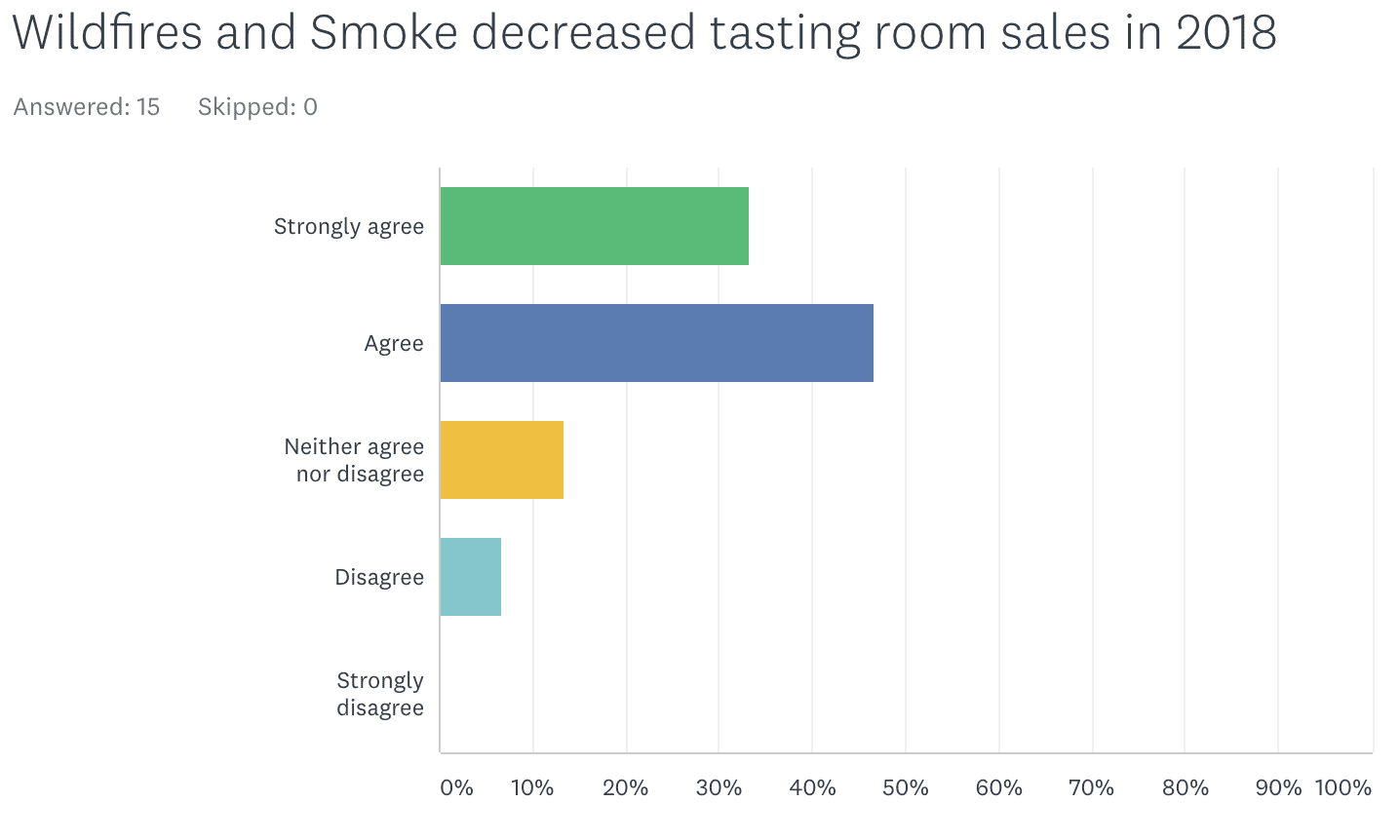

Wildfires and Smoke decreased tasting room sales

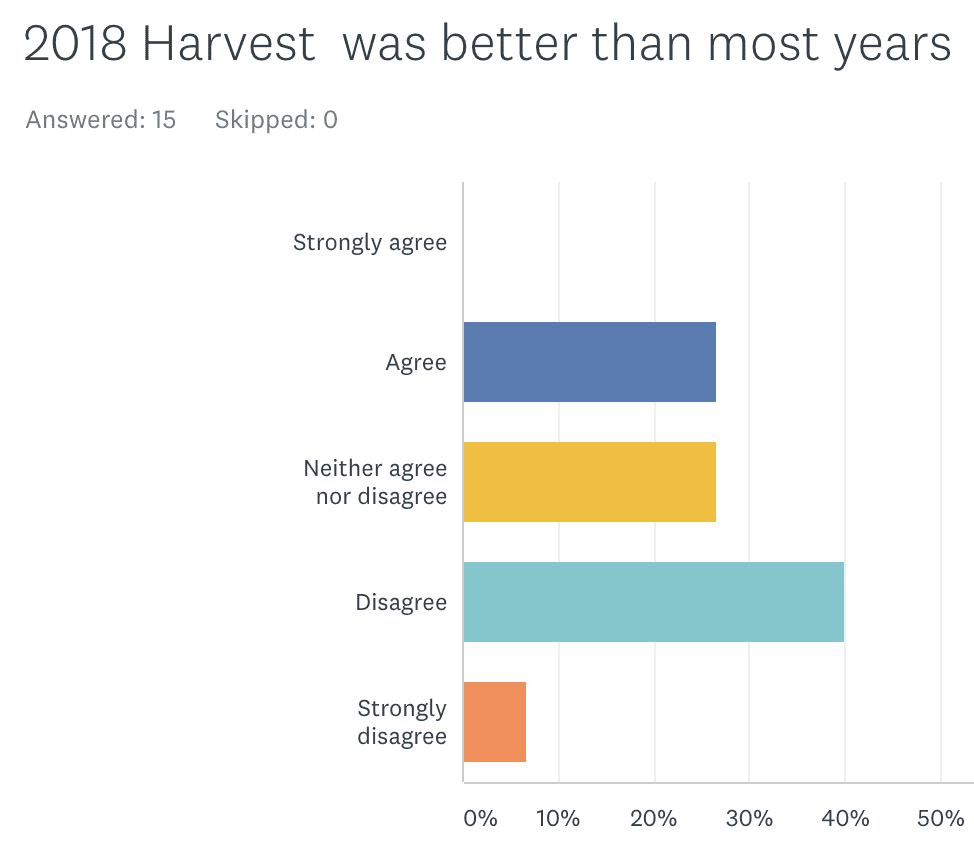

2018 Harvest was better than most years

Lots of good press so far about the 2018 Harvest. However, the survey of leading BC Winemakers was mixed on the 2018 Vintage.

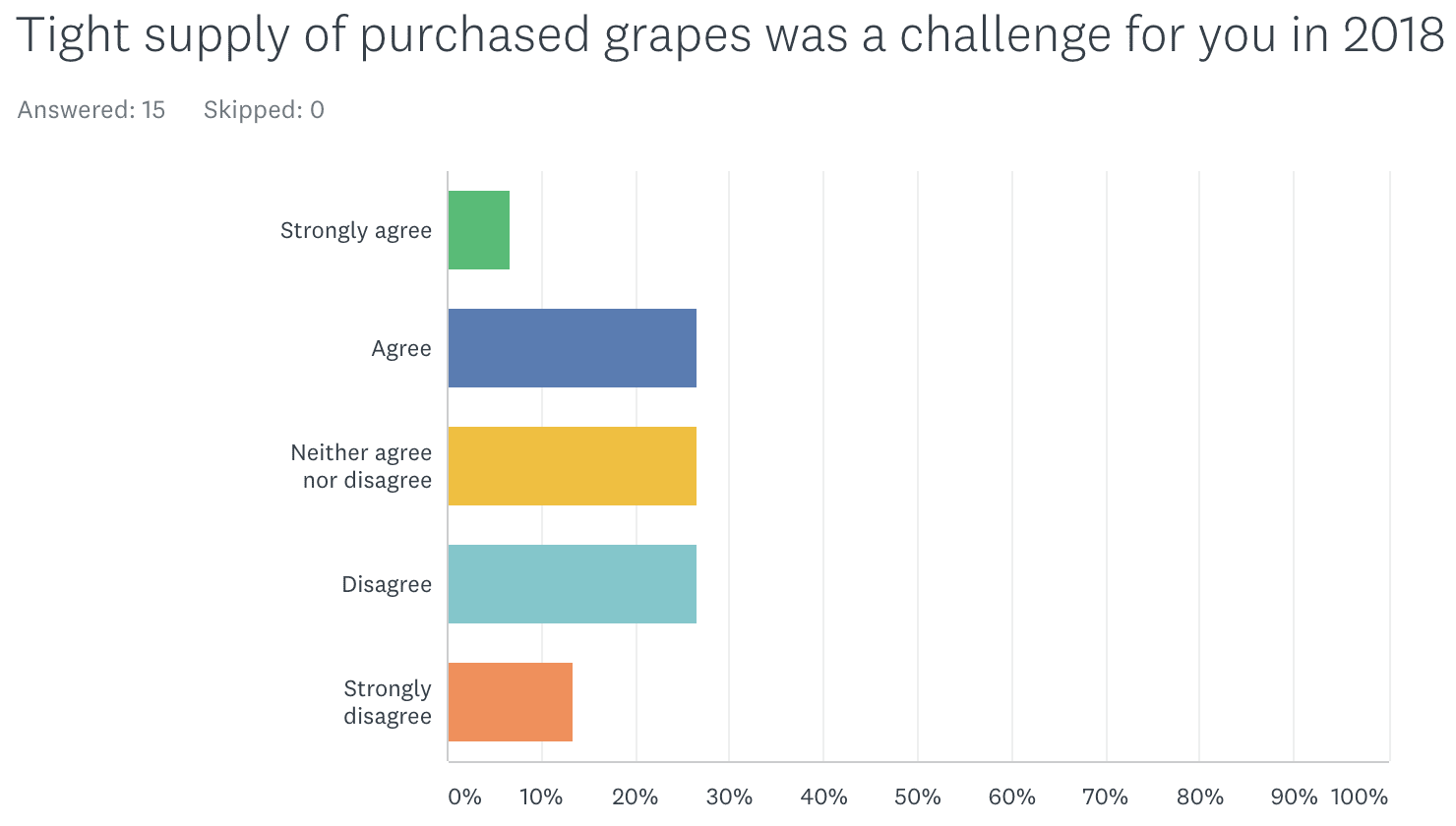

Tight supply of purchased grapes

There were articles written in the Summer predicting a BC grape shortage <8>. However, it doesn’t appear to be a challenge for many winemakers this year. We will have to wait until the wine growers 2018 price report is available to confirm this trend.

Conclusions

References

- BC Wine Grape Crop Trends for 2017

- BC Liquor Market Review Reports

- Trends Changing the Wine Industry

- Grape Shortage Looms in B.C.

- Diamond Estates acquires B.C. winery

- Okanagan Crush Pad Winery Acquires New Vineyard

- CONSTELLATION BRANDS RUMOURED TO BE SELLING OFF US WINE BRANDS

- Grape Shortage Looms in B.C. – Wines & Vines

- Road 13 purchased by Anthony von Mandl

One story that hasn’t been picked up by any wine scribes is the downside of the BCWI Save on Foods grocery store sales channel for small producers / garagistes. With medium and large producers snapping up every loose grape out there and offering big premiums to growers, small producers who had been buying grapes from small growers are seeing grape contracts ( some of which had been in place for years ) disappear. Peaks of 4K per ton for reds! Almost 3k for muscat ?? This means producers such as those who participate in the Garagiste North festival or young winemakers who are making some of the most interesting wines are priced out of the market as larger producers create or expand VQA brands for the grocery store market. We will see the death of custom crush and virtual wineries within 2 years and small producers won’t be able to increase production unless they buy more land.